For larger companies and groups a system of quarterly payments on account based on estimated profits is in place with the first payment being due in the seventh month of. This territory was the sanctuary of the healing god Asklepios.

Tips For Income Tax Saving L Co Chartered Accountants

Sage Tax Calculator Try our easy-to-use income tax calculator aligned to the latest Budget Speech announcements.

. Apply for specific industry tax incentive such as MSC Status. Estimate your tax payable amount accurately to avoid the penalty on underestimation of tax payable under the Income Tax Act. Before the return must be filed.

The Finance Act 2004 introduced an income tax regime known as pre-owned asset tax which aims to reduce the use of common methods of. Monthly tax deductions in Malaysia are governed by the STD mechanism - which reduces the need for employees to pay tax in one lump sum. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return.

Incidental Costs such as your rental advertisement fees legal fees and stamp duty. Heres How A Tax Rebate Can Help You Reduce Your Tax Further. Total taxable income and tax payable.

However under sections 216 2161 217 and 2183 of the Income Tax Act you have the option of filing a Canadian tax return and paying tax on certain types of Canadian-source income using an alternative tax method. Not subject to WHT in the case of holdings of at least 10 owned for at least one year. There is a variety of HEV types and the degree to.

A hybrid electric vehicle HEV is a type of hybrid vehicle that combines a conventional internal combustion engine ICE system with an electric propulsion system hybrid vehicle drivetrainThe presence of the electric powertrain is intended to achieve either better fuel economy than a conventional vehicle or better performance. For non-residents tax withheld is the final tax except for property income in which case it is a payment on account. Title Costs such as the legal fees incurred when.

The first recorded instance of people travelling for medical treatment dates back thousands of years to when Greek pilgrims traveled from the eastern Mediterranean to a small area in the Saronic Gulf called Epidauria. This will be recorded by crediting increasing a deferred tax liability in the statement of financial position and debiting increasing the income tax expense in the statement of profit or loss. Calculate payment under 21B of RPGTA.

Find Out Which Taxable Income Band You Are In. For smaller companies corporation tax is payable nine months and one day after the end of the accounting period to which it relates ie. All employees in Malaysia should be issued with a payslip when they are paid including information such as wages earned and deductions made.

Sage Business Cloud Adviser Portal Providing you with the tools to become a trusted Partner. Currently an overseas company with no permanent establishment in Malaysia would not be liable to register for Sales Tax or Service Tax. Introduction to Transfer Pricing in Malaysia.

Such as company cars and on. Calculate allowable loss automatically. NICs are payable by employees employers and the self-employed and in the 20102011 tax year 965 billion was raised 215 percent of the total collected by HMRC.

Assuming that the tax rate applicable to the company is 25 the deferred tax liability that will be recognised at the end of year 1 is 25 x 300 75. In the US taxpayers Taxpayers A taxpayer is a person or a corporation who has to pay tax to the government based on their income and in the technical sense they are liable for or subject to or obligated to pay tax to the government based on the countrys tax laws. We also have a plagiarism detection system where all our papers are scanned before being delivered to clients.

If the ultimate consumer is a business that collects and pays to the government VAT on its products or services it can reclaim the tax paid. By doing so you may receive a refund for some or. Rental price 70 per night.

Get 247 customer support help when you place a homework help service order with us. Marginal Tax Rate US. For residents tax withheld constitutes a payment on account of final corporate or individual income tax due.

Keep your documents for 7 years. Ownership Costs such as those incurred when searching and inspecting for properties. Allow to key multiple disposers and acquirers and generate related forms automatically.

An individual retirement account is a type of individual retirement arrangement as. An individual retirement account IRA in the United States is a form of pension provided by many financial institutions that provides tax advantages for retirement savings. With the effect of the Finance Act 2019 small companies are with less than N25 Million turnover are now completely exempted from the payment of company income tax.

However from 1 January 2020 foreign service providers of digital services to consumers in Malaysia exceeding MYR500000 per year will be liable to register for Service Tax. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. This is an advantage where the other member of the group has underpaid tax because it can reduce the interest for late payment of tax that the group as a whole has to pay.

We do not take the issue of plagiarism rightly. Expenses That Can be Added to the Cost Base. Also the Value Added Tax which is payable on certain goods and services.

The Company can submit the CP 204A to revise the estimate of tax payable in the sixth orand ninth month of the basis period. Digital Tools Sage has put together key business resources to assist and enable you in the successful running of your business. GPS coordinates of the accommodation Latitude 43825N BANDOL T2 of 36 m2 for 3 people max in a villa with garden and swimming pool to be shared with the owners 5 mins from the coastal path.

As a company we try as much as possible to ensure all orders are plagiarism free. Resignation Vacation or Death of Sole Director or Last Remaining Director. Spa towns and sanitaria were early forms of medical tourism.

How Does Monthly Tax Deduction Work In Malaysia. It is a trust that holds investment assets purchased with a taxpayers earned income for the taxpayers eventual benefit in old age. The Income Tax Act has specified that the books of accounts must be maintained for the purpose of Income Tax.

The expenses that investors can add to a cost base include but are not limited to. All our papers are written from scratch thus producing 100 original work. An additional benefit of being in a loss relief group is that a group member that is due a tax refund can surrender that refund to another member of that group.

One can reduce their tax outgo by making full use of deductions under Section 80. A value-added tax VAT known in some countries as a goods and services tax GST is a type of tax that is assessed incrementally. In that Section 80C of the Income Tax Act offers tax.

It is levied on the price of a product or service at each stage of production distribution or sale to the end consumer. Transfer Price refers to intercompany pricing agreements for the transfer of goods services and intangibles between affiliated individuals according to Malaysia Transfer Pricing Guidelines the Guidelines established in 2012In an ideal world the transfer price would be the same as the current market value that would be. Calculate Tax Relief for loss on disposal automatically.

For the purpose of appointing a new director in the event of the office of a sole director or the last remaining director of the company being vacated the secretary shall as soon as practicable call a meeting of the next of kin other personal representatives or a meeting of members as the case may be. Read more are bifurcated into seven brackets based on their taxable income. Compute tax payable automatically.

These have been prescribed under section 44AA and Rule 6F. Education Tax and Industrial Training Funds are also to be paid by companies operating in Nigeria. These Are The Personal Tax Reliefs You Can Claim In Malaysia.

Calculate Exemption under PU.

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Important Things In Your Payslips Need To Check Payroll Template National Insurance Number Payroll Software

Orisoft Is The More Famous Software Company In Malaysia To Get These Services Easily Like Human Resource Softw Hr Management Payroll Software Human Resources

Tips For Income Tax Saving L Co Chartered Accountants

Guide How To Reduce Company Tax In Malaysia

Details Of 2 Agent Commission Withholding Tax L Co

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Joint And Separate Assessment Acca Global

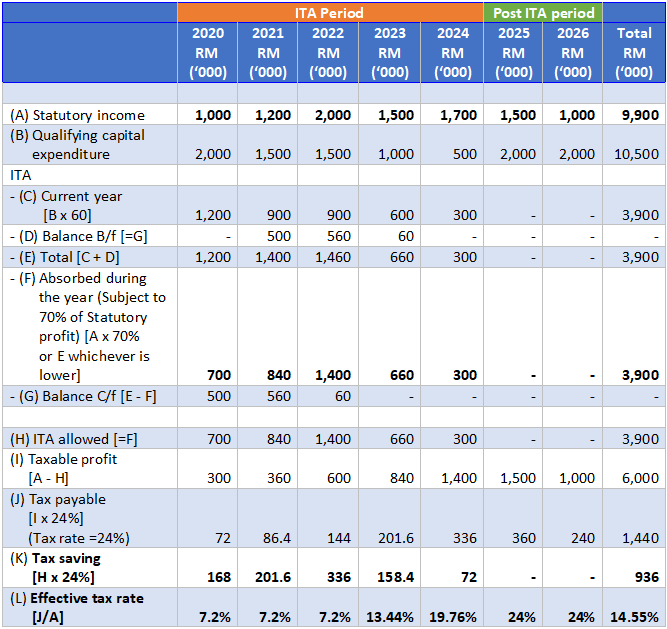

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

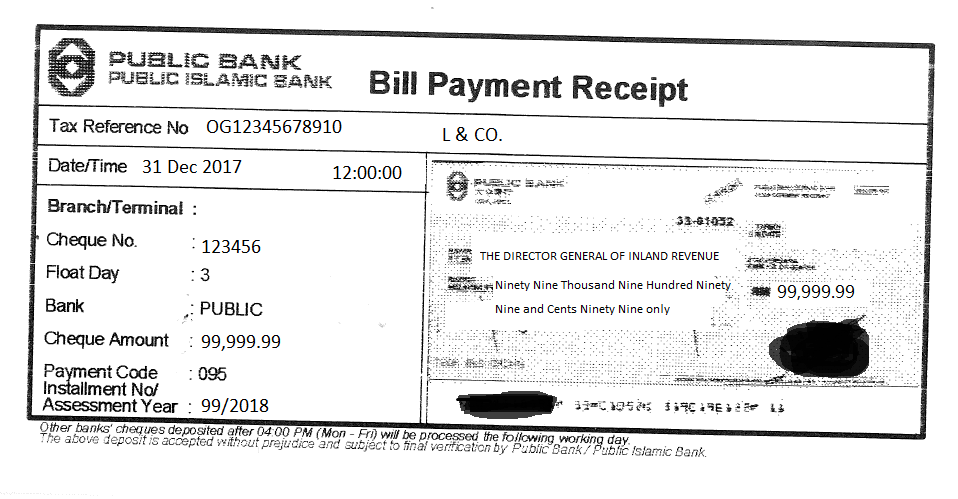

How To Pay Your Income Tax In Malaysia

Corporate Tax Planning In Malaysia Tax Options Tax Position

/Deferredtaxliability_fial_rev-aa7da3f65e644dfea5b55f8ca59f54e4.png)

Deferred Tax Liability Definition How It Works With Examples

Tips For Income Tax Saving L Co Chartered Accountants

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Minimum Corporate Taxation Questions And Answers

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Cukai Pendapatan How To File Income Tax In Malaysia

What Is A Homestead Exemption Protecting The Value Of Your Home